how to check income tax

If you have questions please call us at 208 334-7660 in the Boise area or toll free at 800 972-7660. Check whether you need to report and pay any tax on income you make apart from your main job or earnings.

Indiana Tax Refund Here S When You Can Expect To Receive Yours

You have up to three years from the due date of the return including extensions to file a claim for overpayment of tax due.

. Taxpayers can view the status of refund 10 days after their refund has been sent. In some cases they will send a filer a letter asking for more information. You can also submit any late or partial payments by check or money order to Michigan Department of Treasury Lansing MI 48929.

If you are unsure if you can claim the EITC use the EITC Qualification Assistant. By law businesses and individuals must file an income tax. Income Tax Returns ITR e-filing 2022 - e-filing of Income Tax Returns online made easy with ClearTax.

Normally it takes seven. Income Tax is a tax you pay on your earnings - find out about what it is. Check the Meanings of all Income Tax Refund Status section for more.

By telephone at 317-232-2240 Option 3 to access the automated refund line. HM Revenue and Customs HMRC calculates everyones Income Tax. There is also a possibility that there is a delay from the IT departments end.

If a direct deposit of your Indiana individual income tax refund was requested once DOR initiates the deposit our system will reflect the date the request was processed. Upload form-16 viewdownload form 26AS review your TDS deductions track refund status for income tax filing in India. 1800 103 0025 or 1800 419 0025 91-80-46122000 91-80-61464700.

Check your tax code and Personal Allowance. Use the EITC tables to look up maximum credit amounts by tax year. Your Social Security number SSN or Individual Taxpayer Identification Number ITIN Refund amount.

However they might be taxable on the federal level. 0800 hrs - 2000 hrs Monday to Friday 0900hrs - 1800 hrs. The unrelated business income tax provisions of the Internal Revenue Code ensure that exempt organizations are taxed on income earned from activities that are unrelated to the purpose for which they were granted exempt status.

Check your Income Tax Refund Status Online for FY 2021-22 AY 2022-23 Updated on. Please see the instructions for your federal income tax return for reporting state and local income tax refunds. Sep 06 2022 - 045231 PM.

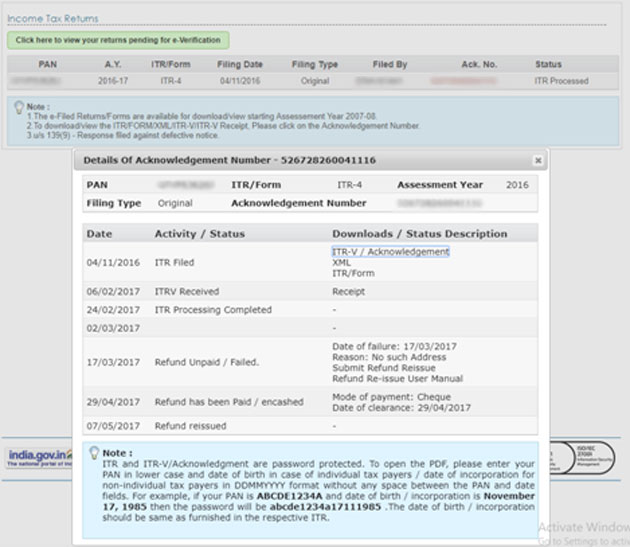

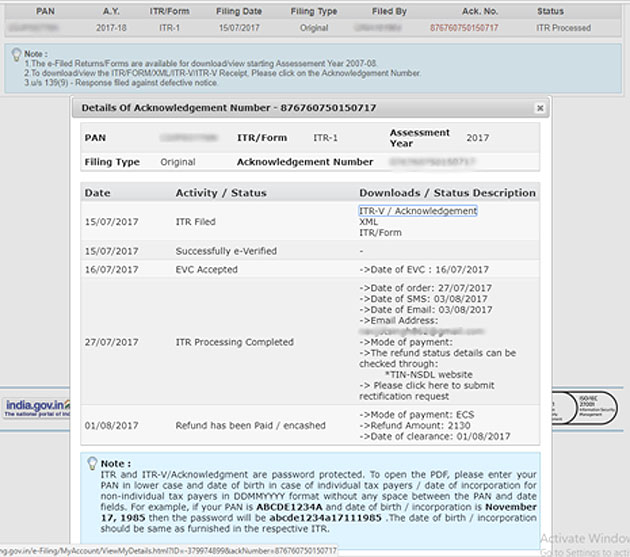

Tax codes and tax rates for individuals How tax rates and tax codes work. Last week the Central Board of Direct Taxes CBDT declared that the department had issued refunds of over Rs 114 lakh crore to more than 197 million taxpayers between April 1 and August 31. Income Tax Return status online using your PAN and Acknowledgment number allocated by the Income Tax Department after filing your Income Tax Return.

Processing of paper tax returns typically takes a minimum of 12 weeks. Under the e-file option select Income tax returns and then. Use the service to.

Join our newsletter to stay in the loop. However as per Taxation and Other Laws Ordinance 2020 any delay in payment of tax which is due for payment from 20-03-2020 to 29-06-2020 shall attract interest at the lower rate of 075 for every month or part thereof if same is paid after the due date but on or before 30-06-2020. Check your ITR Status ie.

Once your Income Tax has been calculated you can use this service to check how much you paid from 6 April 2021 to 5 April 2022. Taxpayers are eligible for an income tax rebate of 50 for individual filers or 100 for joint-filers so long as their income was below 200000 or 400000 depending on filing status. We either automatically assess you or you need to file an IR3 return.

The treatment stream for this strategy is compliance checks. This service covers the current tax year 6 April 2022 to 5 April 2023. However staff members do look at some returns manually to see whether the taxpayer filed income deductions and credits correctly.

For more information visit our web page dedicated to this 2022 Child Tax Rebate program. Click on e-file option. We process most returns through our automated system.

In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have filed an extension by the extended filing due date of October 17 2022. Two ways to check the status of a refund. To claim a refund of Vermont withholding or estimated tax payments you must file a Form IN-111 Vermont Income Tax Return.

Who can I contact for more information. For instance for FY19-20 a software update led to delayed returns processing. Use our tax code finder and tax on.

What happens at the end of the tax year After the end of the tax year we work out if youve paid the right amount of tax. See if your tax code has changed. You will have to type your PAN.

Tax year of the refund. Income Tax is a tax you pay on your earnings - find out about what it is how you pay and how to check youre paying the right amount using HMRCs tax calculator Income Tax. How income gets taxed Income is taxed differently depending on where it comes from.

E-Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries. The above calculator provides for interest calculation as per Income-tax Act. Visit wwwincometaxgovin and log in to your account by entering PANAadhaar number as user ID and your password.

Check how much Income Tax you paid last year 6 April 2021 to 5 April 2022. Be sure to include your complete Social Security number and tax year on the check or money order. An income tax is a tax that governments impose on financial income generated by all entities within their jurisdiction.

The steps listed below can be used to check the status of your income tax refund on the governments new income tax portal. To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit limits for the current previous and upcoming tax years. Those payments can be made using the Michigan Individual Income Tax e-Payments system.

To check the status of your personal income tax refund youll need the following information. The Income Tax Department offers an online facility for tracking your Income Tax Refund and its status.

Nj Issuing Income Tax Refunds On Schedule How To Check On Yours

2020 Income Tax Filing Tips For People Who Got Unemployment Benefits Or Never Got Stimulus Check Abc7 Chicago

Bill To Eliminate Ohio S Personal Income Tax Introduced In State Legislature Wsyx

How To Calculate Federal Income Tax 11 Steps With Pictures

Your Tax Return Check Was Lost Or Stolen What Next

Income Tax Refund Status How To Check Income Tax Refund Status

Congress Again Considers Free Irs Income Tax Filing System Cpa Practice Advisor

How To Check The Status On An H R Block Tax Return Sapling

Closeup Of Us Federal Income Tax Refund Check Usa Stock Photo Alamy

Income Tax Check And Envelopes With Return Greater New Orleans Federal Credit Union

Here S What To Know About Filing For An Extension On Your Tax Returns Abc News

Do I Need To File A Tax Return Forbes Advisor

How To Find Out If A Federal Tax Return Has Been Processed

Want To Track Your 2022 Tax Rebate Check Out This Tool From The Idaho State Tax Commission Idaho Capital Sun

/cloudfront-us-east-1.images.arcpublishing.com/gray/L6QOIUO7NRFJ3ENZ4A52GTLCKU.bmp)

5 Things To Remember When Filing Tax Returns In 2022

Here S Why Your Tax Return May Be Flagged By The Irs

Income Tax Refund Status How To Check Income Tax Refund Status

0 Response to "how to check income tax"

Post a Comment