stamp duty calculation in malaysia for contract

For residential homes priced between RM300000 to RM25 million. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Stamp Duty Malaysia 2022 Commonly Asked Questions Malaysia Housing Loan

If you are looking for VIP Independnet Escorts in Aerocity and Call Girls at best price then call us.

. Lease agreement registration fees amount to 3 of the value of the annual rent paid during the tax year including premises charges if any. The tax usually takes the form of a nominal lump sum. The majority of property buyers will be required to pay stamp duty if the property price is above the threshold.

Additional centimes also apply at a 5 rate of the registration fees. Stamp duties and registration fees should be paid for the total duration of the lease agreement. This is subject to a minimum 10 discount by the developer and an exemption on the instrument of transfer is limited to the first RM1 million of the property price.

Currently first-time buyers are exempt from paying stamp duty along with anybody purchasing a property below 500000 in England. The exact amount may vary from this amount depending on your lenders. Generally it is easy to calculate stamp duty according to the rates provided by the Indian Stamp Act or the State.

MORTGAGE TAX -- Tax on mortgages usually in the form of a stamp duty levied on the mortgage document. Initial Principal 100000. MOTIVE TEST -- Test often found in tax rules which are designed to prevent tax avoidance.

Your company is required to pay for Stamp Duty when instruments are involved which are written legal. Simply accumulate your FX Spot Contract booking from 15 August 31 December 2022. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

In Malaysia the products that we manufacture depends. Registration fees and stamp duties. For example the rules may provide that certain consequences will follow if the sole main or principal purpose of certain transaction is the reduction of.

Effective from 1st April 2017 commercial. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. The stamp duty is to be made by the purchaser or buyer and not the seller.

Aerocity Escorts 9831443300 provides the best Escort Service in Aerocity. Formally a string is a finite ordered sequence of characters such as letters digits or spaces. Full Stamp Duty Exemption on Loan Agreement.

So if you need to be on a safer side you can make the agreement on a Stamp paper of the appropriate value as prescribed by the government. As of FY 2012 IVIE see the Other taxes section for more information replaced the national income tax IRPEF on incomes deriving from foreign real estate not rented whereas rented real estates must be reported in any case in the tax return. UOB China UOB Brunei UOB Hong Kong UOB Indonesia UOB Malaysia UOB Mumbai UOB Philippines UOB Seoul UOB Taipei UOB Thailand UOB Tokyo UOB Vietnam UOB Yangon.

Meanwhile to ensure that Bursa Malaysia remains dynamic the MoF said the government will impose a stamp duty of 015 per cent on share contract notes. Get 247 customer support help when you place a homework help service order with us. Mortgage loan basics Basic concepts and legal regulation.

Understanding the tax obligations of companies in Malaysia makes tax compliance a smoother process. Check out the company tax rates of 2021. To get the best deal among the listed contractors customers are advised to liaise and request for quotations prior to appointing one.

However in certain circumstances it is levied as a percentage of the value of the obligation or the right referred to within a contract. Basic deposit refund calculation. Stamp duties are levied on certain documents contracts and registers as specified in the stamp duty law.

Currently under this category customers are required to pay upfront all these essential charges which include the Connection Charges Stamp Duty and Security Deposit to apply for electricity. Get 247 customer support help when you place a homework help service order with us. ASCII characters only characters found on a standard US keyboard.

Stamp duty is levied on movable and immovable property and property rights if they were acquired in Hungary unless an international agreement rules otherwise. 500- whichever is lower. Can you advise me on the total number of documents which require stamp duty as per Murabaha contract of Bank Islam Baiti loan.

The agreement should be printed on a Stamp paper of minimum value of Rs100 or 200-. Certain assets including houses land automobiles and motorcycles etc that are subject to registration of ownership are subject to stamp duty. Sign the Electricity Supply contract Electricity Application form with TNB.

Must contain at least 4 different symbols. Natural resources tax NRT. Property Purchase Price.

003 of contract value subject to cap of RM200. This calculation is a guide to how much your monthly repayments would be. Subject to a minimum 10 discount by the developer.

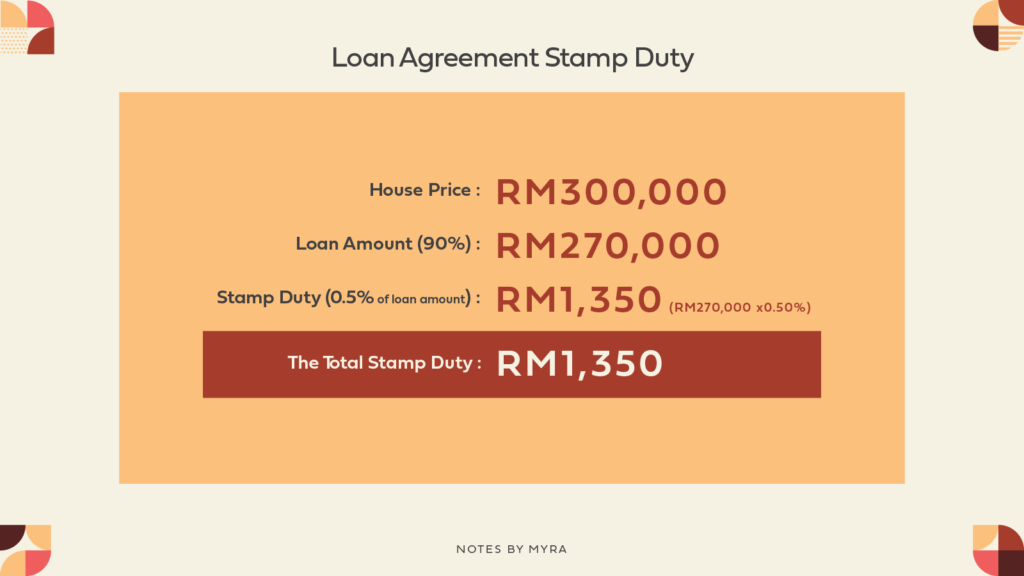

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Instruments of transfer and loan agreement for the purchase of residential homes priced between RM300000 to RM25 million will enjoy a stamp duty exemption. The stamp duty rates vary depending on the asset transferred.

The taxable income is 100 of the rental income. I read somewhere that Islamic loans incur higher stamp duty due to more number of legal documents. To get the best deals among the listed contractors you are advised to liaise and request for quotations prior to appointing one.

Contract payment for services done in Malaysia. Updated reduced rates of Stamp Duty Land Tax SDLT for residential properties purchased from 8 July 2020 until 31 March 2021 inclusive. Please see the Other taxes section in the Individual tax summary.

The calculation is as follows. The empty string is the special case where the sequence has length zero so there are no symbols in the string. Stamp duty and security deposit upfront to apply for electricity.

The maximum stamp duty on each note is limited to RM1000 and any amount over that limit will be remitted. The stamp duty and. Stamp duty is a standard part of buying a property and should be factored into your deposit.

In general gift duty arises on the date when a contract concerning a gift is concluded or if there is no contract available on the date when the acquisition without any. Exemption on MOT is limited to the first RM1 million of the property price. Full Stamp Duty Exemption on MOT and Loan Agreement.

Stamp duty is 1 of the total rent plus deposit paid annually or Rs. An A list of over 50 best dividend yield stocks in Malaysia with super actionable tips to help you get the best passive income for retirement from stocks. A full stamp duty exemption is given on.

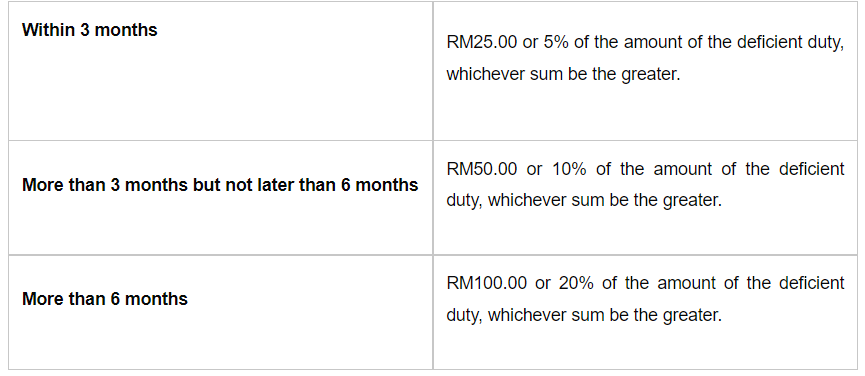

Refund Deposit. Delay in payment of stamp duty can make the individual liable to pay a fine ranging from 2 to 200 of the total payable amount. C Stamp duty RM1 for every RM1000 worth of value for stocks of mid and small cap companies in Malaysia will be waived with effect.

The remittance is applicable for all contract notes from Jan 1 2022 to Dec 31. 6 to 30 characters long.

Malaysia Real Estate Kuala Lumpur Property Legal Fees Stamp Duty Calculation When Buying A House In Malaysia

How Much Does The Stamp Duty For Your New Home Cost

Buying Property And Stamp Duty Planning Action Real Estate Valuers

Malaysia 2021 Vs 2022 Stamp Duty On Share Trading Contract Notes Youtube

Business Sale Agreement Is Subject To Nominal Stamp Duty International Tax Review

After Considering Prosperity Tax Klci Earnings Could Potentially Fall By 6 In 2022 Cgs Cimb The Edge Markets

Malaysia Landlord 2018 Legal Fee Stamp Duty My Lawyer

Malaysian Tax Law Stamp Duty Lexology

Stamp Duty In Malaysia 2022 Malaysia Housing Loan

How To Write Your Own Tenancy Agreement In Malaysia Recommend My

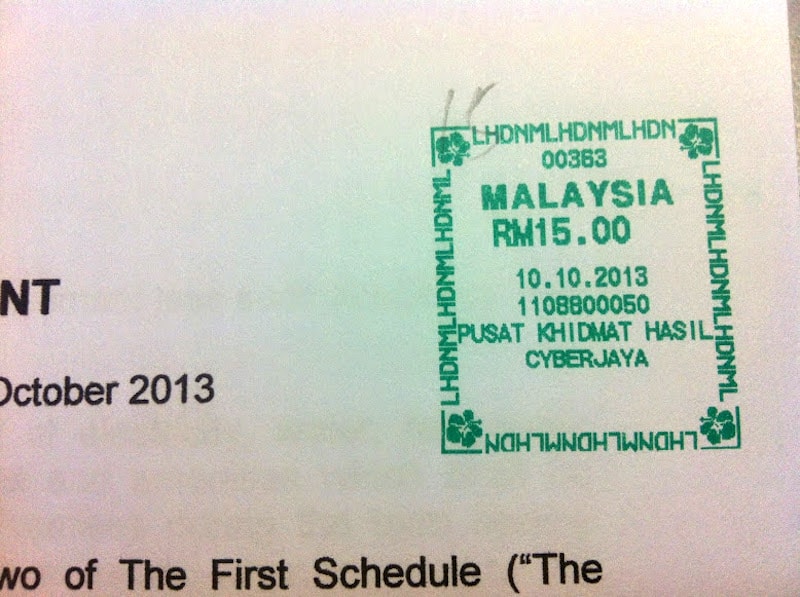

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My

Ad Valorem Stamp Duty Damian S L Yeo L C Goh

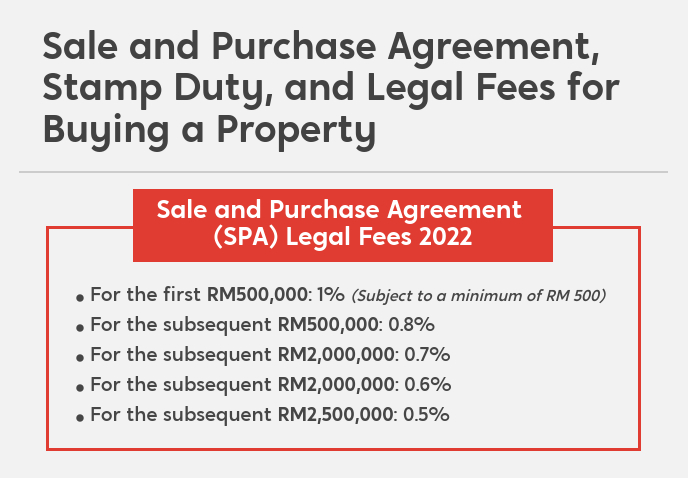

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

Property Spa And Loan Legal Fees And Stamp Duty Calculator Mypf My

Tenancy Agreement Stamp Duty Calculator Malaysia Creatifwerks

Best Home Loan Calculator In Malaysia With Legal Fees Stamp Duty Loanstreet

Rental Agreement Stamp Duty Malaysia Speedhome

Malaysia Property Stamp Duty Calculation Youtube

Malaysia Law Firm With More Than 30 Lawyers Since 2009 In Pj Kl Johor Penang Perak Negeri Sembilan

0 Response to "stamp duty calculation in malaysia for contract"

Post a Comment